Mumbai, Aug 8 (UNI) As widely expected by markets and policy-watchers, the Reserve Bank of India (RBI)’s Monetary Policy Committee (MPC) on Thursday decided to keep the policy repo rate unchanged at 6.50% for the ninth consecutive time.

The MPC also decided, by a majority of 4 out of 6 members, to remain focused on the withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

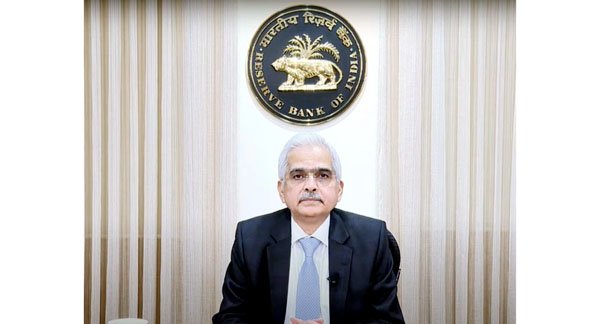

“The Monetary Policy Committee (MPC) met on August 6, 7, and 8. After a detailed assessment of the evolving macroeconomic conditions and the overall outlook, it was decided by a majority of 4:2 members to keep the policy repo rate unchanged at 6.5%. Consequently, the standing deposit facility (SDF) rate remains at 6.25%, and the marginal standing facility (MSF) rate and the bank rate are at 6.75%,” RBI Governor Shaktikanta Das said.

The repo rate refers to the interest rate at which the RBI lends to commercial banks. A high repo rate means the cost of borrowing for banks is going up, which, as a result, leads to a rise in loan EMIs.

The RBI Governor noted that while India’s growth remains strong, inflation is broadly on a declining trajectory, and strong macroeconomic fundamentals in India have also led to greater confidence in the country’s economic prospects.

Stating the rationale for the MPC decision, the RBI Governor said that headline inflation, after remaining steady at 4.8% during April and May this year, increased to 5.1% in June, primarily driven by the food component, which remains stubborn.

“While the fuel group remained in deflation, the expected moderation in headline inflation during the second quarter of 2024–25 on account of favourable base effects is likely to reverse in the third quarter,” he said.

Retail inflation is one of the most important factors considered by the RBI while determining the key lending rate.